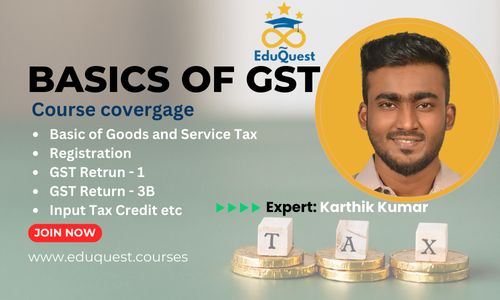

About Course

The Basic Goods and Services Tax (GST) Course is designed to provide learners with a clear and practical understanding of GST, one of the most significant tax reforms in recent history. This course is perfect for beginners and professionals who want to develop a working knowledge of GST and its applications in daily business operations.

By the end of this course, you’ll have a comprehensive understanding of GST and the confidence to handle basic GST-related responsibilities efficiently, whether for personal use or in a professional setting.

Whom will the course benefit?

This course is ideal for:

• Entrepreneurs and small business owners who want to manage their GST compliance on their own.

• People in Finance and accounting job roles, looking to add GST expertise to their skillset.

• Students pursuing a career in finance, accounting, or tax consultancy.

• Anyone seeking a foundational understanding of GST.

• People wanting to take up entry level jobs in Finance.

Course Content

Basics of GST

-

Amendments in core and non core fields

04:13 -

GST Registration

19:20 -

GSTR1,2b and 3b

08:40 -

ITC ,compostion schme and others

00:00 -

Updates

03:03

Blue Lobster

Blue Lobster